Free Week Stock Markets Forecasts

We provide professional newsletter analytics by paid subscription, and for the foreseeable future we are showcasing our approach(s) to financial markets analysis investment and trading by featuring sample free forecasts of the markets as measured by S&P500 (^GSPC) and large CAPs Oracle corporation (ORCL) and or MicroSoft Corporation (MSFT) weekly or more frequent forecasts, as is most convenient...

Disclaimer: We request that you review NASDAQ and CBOE risks associated with stock markets and options markets investing.

News News News!!! We have begun automating our website, to provide you with do-it-yourself analysis, charts graphs and technical analysis and indicators. We utilize the 'carat' stock symbol convention of finance.yahoo.com with ^GSPC (S&P500, etc. ) and ^VIX (volatility index, etc.) indices and the usual stock ticker symbols e..x MSFT (Microsoft) ...Note the 'carat' and alternative for index symbols, if you can't use the stock or index symbol on yahoo finance, you probably can't use it on our website.

Disclaimer: We request that you review NASDAQ and CBOE risks associated with stock markets and options markets investing.

News News News!!! We have begun automating our website, to provide you with do-it-yourself analysis, charts graphs and technical analysis and indicators. We utilize the 'carat' stock symbol convention of finance.yahoo.com with ^GSPC (S&P500, etc. ) and ^VIX (volatility index, etc.) indices and the usual stock ticker symbols e..x MSFT (Microsoft) ...Note the 'carat' and alternative for index symbols, if you can't use the stock or index symbol on yahoo finance, you probably can't use it on our website.

Free Stock Chart Analytics (For Free)...Click To View All Indicators - view

Subscribe to Our Newsletter 'Updates' For Free!

Dear Readers...are you interested in receiving 'updates' delivered to your email box for free????

If you receive benefit from our free forecasts, and you would like to be notified as updates are posted on the free portion of our newsletter, then subscribe simply by filling out our subscriber email form, select from the menu to the left

If you receive benefit from our free forecasts, and you would like to be notified as updates are posted on the free portion of our newsletter, then subscribe simply by filling out our subscriber email form, select from the menu to the left

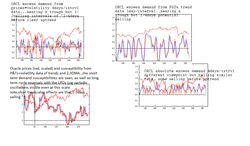

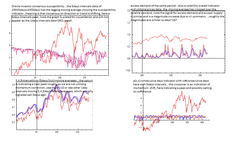

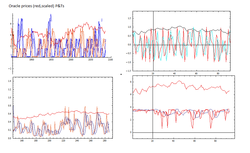

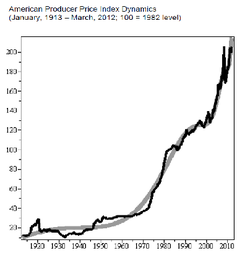

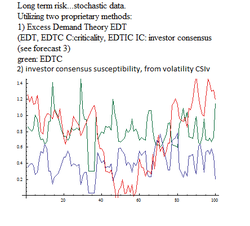

Update of our LTR long term risk of corrections/crashes 17April2014.

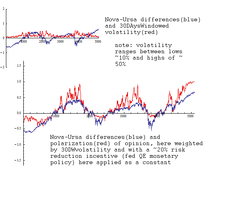

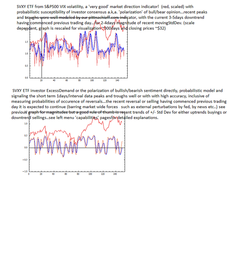

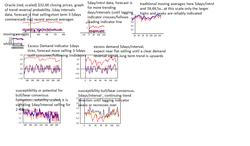

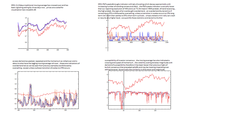

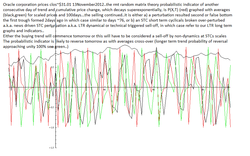

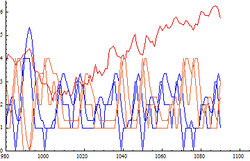

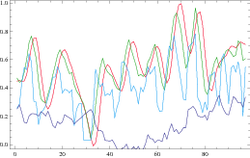

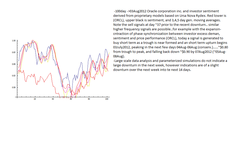

Fig.1. is the graph f the ExcessDemand theory of markets (Michael et. al. 2002, Chowdhury-Dabshih 1998) with data of the RYDEX funds' NOVA/URSA or Bull/Bear funds, literally voting by dollars! The mismatch between dollars invested in the bullish NOVA fund and the bearish URSA fund is a measure of excess demand, sentiment, confidence and of polarization. Market analysts have utilized the ratio of ursa/nova to estimate this effect of investor confidence before as by moving averages to time peaks (google it!), however we utilize this data as input into the full many-particle physics theory of phase transitions, as we also utilize CBOE put/call options (derivatives), the SVXY/UVXY data sets of prices of ETFs, and as similarly any sentiment and excess demand data set inclusive of investor confidence bull/bear ratios and 2nd tier bid/ask spreads and ratios/differences can be utilized...other data sets utilized can be any consumer confidence (bull/bear) data and proportionately any opposing sets of data relevant to a asset here the full S&P500 and the US economy and noting the increased correlation globally by indices and their economies with the US indices and economy reported elsewhere occurring at higher or increasing levels since the year ~2000...

The Blue line is the nova-ursa differences rescaled for visualization to unity, and the red line is the volatility weighted (variance<->Temperature for physicists) ExcessDemand curve graph, this shifted by perturbation by fed monetary policy of interest rates adjustments and QE bond purchase programs as a driving magnetic field like force a-periodic in nature (highest incentives at market bottoms to stimulate recoveries and lowest at market tops to curb bubbles inflation speculation etc..)...This shifts the red line up from symmetric to asymmetric and contributes significantly to the ExcessDemand by markets' investors.

This ExcessDemand then nears +1 at market tops just before a crash ( a large correction if you will) and reduces to near zero -0.2 to -0.3 just as a market bottom following an extended crash or meltdown has occurred...

The graphs are of ~15years and ~5000 trading days, with the recent S&P500 ~50% crash of 2008 lasting ~1year the large draw down bottoming at days '~3800' in 2009 and the preceding ~2000 three year ~3years crash bottoming in days'~2300'.

We note that any bull/bear demand/supply data ED graph for any asset or index or economic market should first be rescaled to unity prior to its input to the excess demand theory, this assuring consistent multi-scale magnitude effects of demand/supply scale well with their volatilities at unity scaling for any range and any asset.

Fig.1. is the graph f the ExcessDemand theory of markets (Michael et. al. 2002, Chowdhury-Dabshih 1998) with data of the RYDEX funds' NOVA/URSA or Bull/Bear funds, literally voting by dollars! The mismatch between dollars invested in the bullish NOVA fund and the bearish URSA fund is a measure of excess demand, sentiment, confidence and of polarization. Market analysts have utilized the ratio of ursa/nova to estimate this effect of investor confidence before as by moving averages to time peaks (google it!), however we utilize this data as input into the full many-particle physics theory of phase transitions, as we also utilize CBOE put/call options (derivatives), the SVXY/UVXY data sets of prices of ETFs, and as similarly any sentiment and excess demand data set inclusive of investor confidence bull/bear ratios and 2nd tier bid/ask spreads and ratios/differences can be utilized...other data sets utilized can be any consumer confidence (bull/bear) data and proportionately any opposing sets of data relevant to a asset here the full S&P500 and the US economy and noting the increased correlation globally by indices and their economies with the US indices and economy reported elsewhere occurring at higher or increasing levels since the year ~2000...

The Blue line is the nova-ursa differences rescaled for visualization to unity, and the red line is the volatility weighted (variance<->Temperature for physicists) ExcessDemand curve graph, this shifted by perturbation by fed monetary policy of interest rates adjustments and QE bond purchase programs as a driving magnetic field like force a-periodic in nature (highest incentives at market bottoms to stimulate recoveries and lowest at market tops to curb bubbles inflation speculation etc..)...This shifts the red line up from symmetric to asymmetric and contributes significantly to the ExcessDemand by markets' investors.

This ExcessDemand then nears +1 at market tops just before a crash ( a large correction if you will) and reduces to near zero -0.2 to -0.3 just as a market bottom following an extended crash or meltdown has occurred...

The graphs are of ~15years and ~5000 trading days, with the recent S&P500 ~50% crash of 2008 lasting ~1year the large draw down bottoming at days '~3800' in 2009 and the preceding ~2000 three year ~3years crash bottoming in days'~2300'.

We note that any bull/bear demand/supply data ED graph for any asset or index or economic market should first be rescaled to unity prior to its input to the excess demand theory, this assuring consistent multi-scale magnitude effects of demand/supply scale well with their volatilities at unity scaling for any range and any asset.

Forecast 127 : 20October2013-27October2013

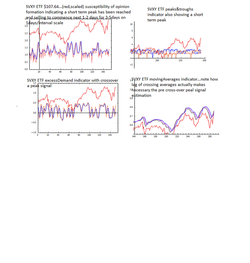

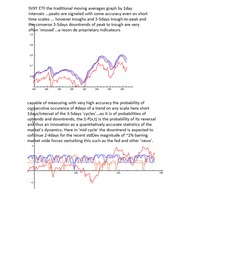

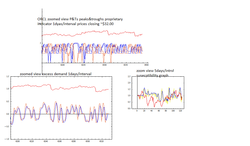

svxy ETF 1days/interval or short term at $107.64...see previous long term forecast for weeklys..indicators are proprietary probabilistic...forecast is for selling to commence next 1-2 days for 3-5 trading days for +/- stdDeviation of recent moving averages or ~10%...

Forecast 126.5 : 15Oct2013

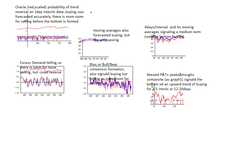

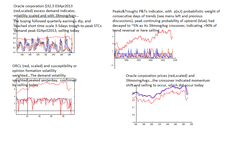

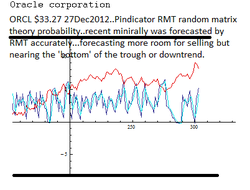

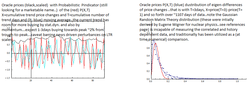

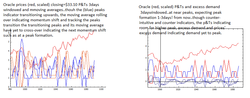

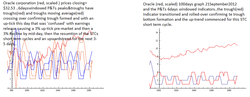

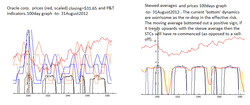

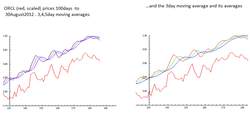

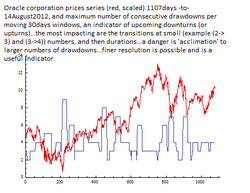

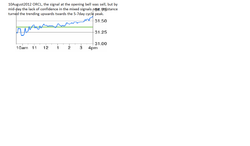

the ORCL oracle corp. (red, scaled) ~$33 by

q-parameterized nonextensive probability of random matrix theory...meaning is the very random stock market is by our math very accurately measured (see insets graphs of P(X,T) ) and therefore measuring the probability of a trend occuring AND its reversal probability is >95% accurate...remaining task is for you the investor to portfolio your risk accordingly...see graphs of short term and weekly scales for forecasts.

q-parameterized nonextensive probability of random matrix theory...meaning is the very random stock market is by our math very accurately measured (see insets graphs of P(X,T) ) and therefore measuring the probability of a trend occuring AND its reversal probability is >95% accurate...remaining task is for you the investor to portfolio your risk accordingly...see graphs of short term and weekly scales for forecasts.

Forecast 126L: 08October2013-18October2013

For a change to show our ability top track market wide statistical dynamics we

showcase our proprietary indicators applied to SVXY ETF as derived from VIX

volatility index of the S&P500...here graphs are of 4days/interval prices

data...see graphs and insets for explanations and forecasts.

showcase our proprietary indicators applied to SVXY ETF as derived from VIX

volatility index of the S&P500...here graphs are of 4days/interval prices

data...see graphs and insets for explanations and forecasts.

Forecast 126

For a change to show our ability to track market wide statistical dynamics we

showcase our proprietary indicators applied to SVXY ETF as derived from VIX

volatility index of the S&P500...here graphs are of 1days/interval prices

data...see graphs and insets for explanations and forecasts.

showcase our proprietary indicators applied to SVXY ETF as derived from VIX

volatility index of the S&P500...here graphs are of 1days/interval prices

data...see graphs and insets for explanations and forecasts.

Forecast 126L 03Oct2013-

For a change to show our ability top track market wide statistical dynamics we showcase our proprietary indicators applied to SVXY ETF as derived from VIX volatility index of the S&P500...here graphs are of 1days/interval prices data...see graphs and insets for explanations and forecasts.

Forecast 125:30Sept2013-07Oct2013

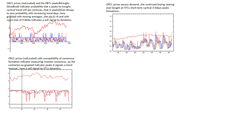

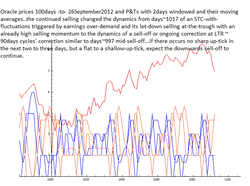

Oracle prices and short term forecasts of the 3-5days trough to peak and its converses...several of our proprietary indicators are showcased. See graphs and insets for explanations click on the graphs and zoom out.

Forecast 124: 05August2013-26August2013

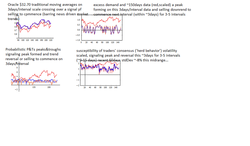

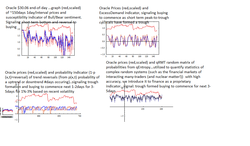

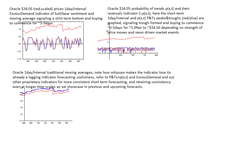

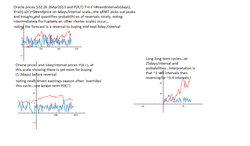

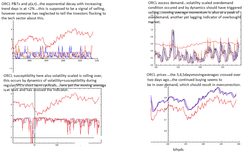

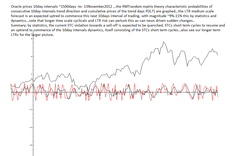

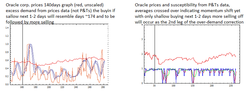

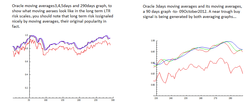

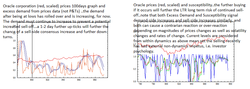

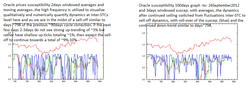

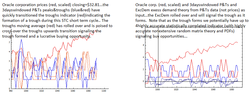

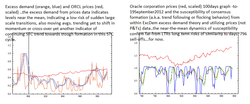

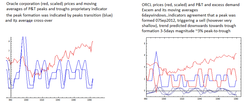

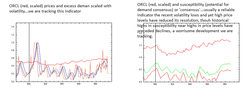

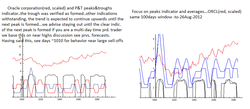

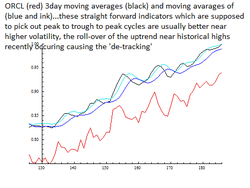

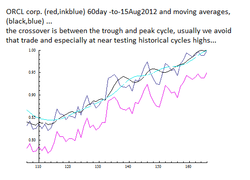

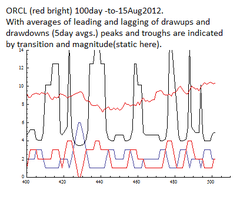

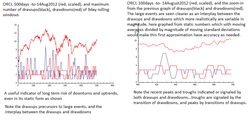

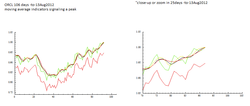

Oracle $32.59 closing Fri 02Aug2013 ...the graphs are proprietary indicators by Pittnachioff.com , of 3days/interval data of demand/supply probabilities P&T, of susceptibility of trending consensus or 'herding' behavior (we prefer the term consensus), and compared with traditional moving averages indicator...all are signaling a midterm peak to be followed by reversal or selling next ~3days of trading for ~9-15 days or 3-5intervals and with magnitude of recent 20daysX3~60days moving stdDeviation of +/-10% ...within this midterm are fluctuations of short term stochastics of 3-5days (actually trading days) , which as you know have recently whipsawed yet trended upwards towards the options expirey expectation of traders towards $33.00 price target by Sept-Oct, and by valuation as a perception that recent selling of ORCL was an overreaction to market performance expectations as earnings were along estimates....NOTE this has to be balanced against market wide forces of news driven desire to rally on perceived economic growth data, and fed qe easing or bond buying and its forecasted tapering this Sept-Oct... our advice is to take a look at options expirey and how often actual price pinned to the expected price, and trade accordingly whilst being hedged if a long term trader, or if a short timing trader to take a look at our forecasted timing record (quite high in accuracy!) and order our software or subscribe or merely take afvantage of our free forecasts.

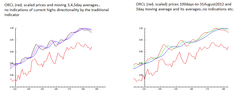

forecast 126: 27July-05August2013

Oracle prices data forecasts short term, by proprietary indicators at Pittnachioff.com ...this is an update see recent forecasts for longer term forecasts and trends. Forecast is selling 3-5days which began last thursaday shallowly but was interrupted by friday's end of the week buying, and selling to continue today monday, mafmnitudes recent +/-stdDev..

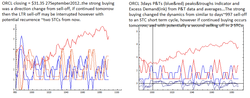

Forecast 125: 22July2013-

ORCL short term forecasts, a trough was formed and buying is expected to commence for 3-5days ~22July2013...see previous recent forecasts for longer term.

Forecast 124: 18July2013-25July2013

Oracle closing prices ~$32.00 (before close) and graphs of proprietary indicators at 1day and 5day per inerval (tick) data, forecasts of short term cycles that occur on 3-5days trough to peak and longer term cycles that occur on 3-5 'intervals' from trough to peak (see graphs)...

forecast is selling commenced today and is expected to occur for 3-5days however expected to be shallow until market direction and the demand for ORCL stock and expectations of it reaching ~$33.00 within ~20days as per options expirey (not shown here) spread vie. On longer time scales the uptrend is expected to continue for 1-3 intervals ~5-15 days until the lagging indicator rolls over or crosses the leading indicator... SEE ZOOM OUT VIEW NEXT

forecast is selling commenced today and is expected to occur for 3-5days however expected to be shallow until market direction and the demand for ORCL stock and expectations of it reaching ~$33.00 within ~20days as per options expirey (not shown here) spread vie. On longer time scales the uptrend is expected to continue for 1-3 intervals ~5-15 days until the lagging indicator rolls over or crosses the leading indicator... SEE ZOOM OUT VIEW NEXT

zoom out views

selected zoom out views ORCL forecasted by out selected indicators

Forecast 122 : 03July-11July2013

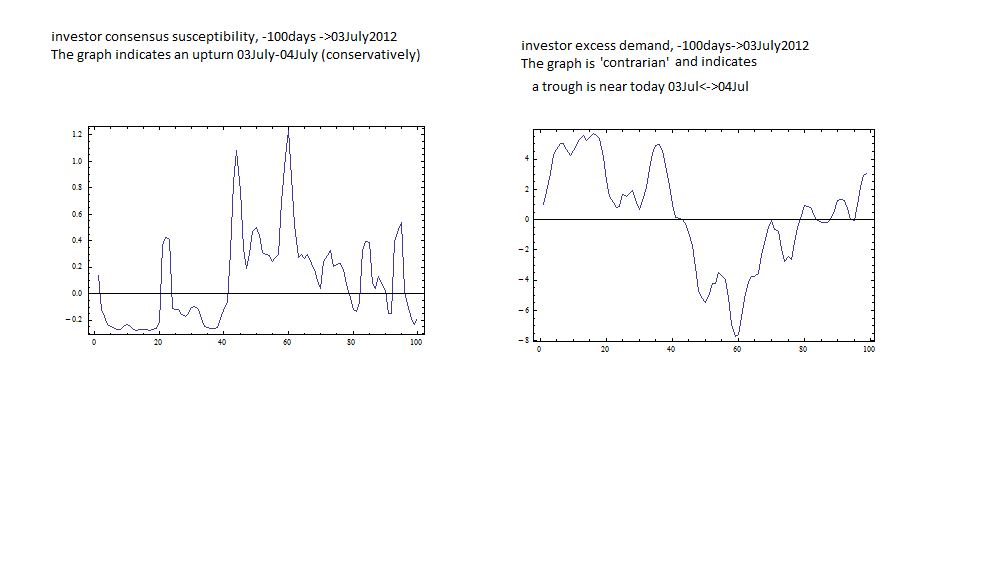

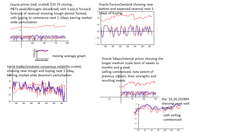

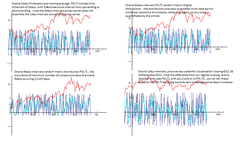

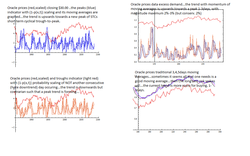

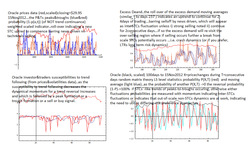

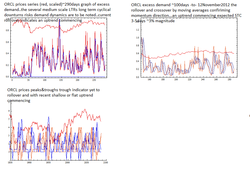

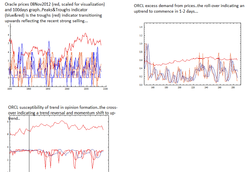

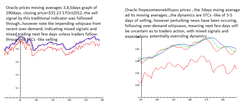

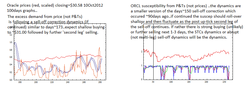

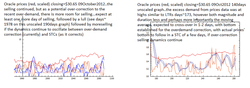

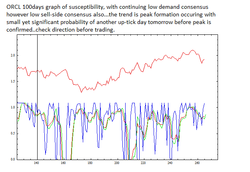

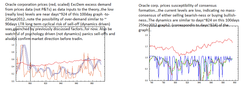

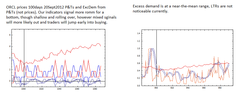

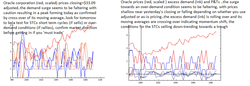

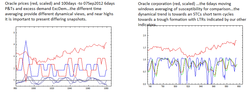

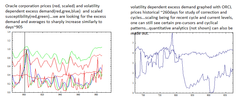

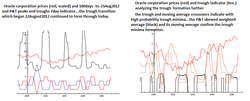

Oracle prices closing $30.70 ...we show several of our proprietary indicators. Graph1 is the Bull/Bear consensus formation, indicating more buying potential, and from graph2 Excess Demand with a similar forecast however measuring demand strength or bias...Graph3 is our probability of occurence of trends AND their probability of reversal! forecast is additional 1-2 days of trading buying before a short term peak is formed and recersal occurs...see graphs for details and comments. Graph4 is the qRMT random matrix theory probability and its momentumm also in agreement with additional buying before peak on this short term scale of 1days/interval occurs and selling commences. Magnitudes are recent averages which for ORCL stock recently off of its sharp drop are ranging from ~2%-4% per peak-to-trough, lasting 3-5days per.

Note: for explanations of the math behind these probabilistic proprietary indicators (patents filed), see "capabilities" pages menu left.

Note: for explanations of the math behind these probabilistic proprietary indicators (patents filed), see "capabilities" pages menu left.

Forecast 121: 24June2013-01July2013

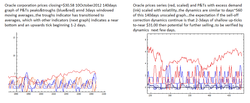

Oracle inc. prices $29.96 closing and several of our proprietary indicators that utilize probability AND momentum with volatility to accurately model the statistical dynamics of markets here focused on ORCL stock prices though we analyze overall markets and indices elsewhere(menu left, we update this sporadically). The statistics of a time series of prices of real markets stocks you will note follows a 'superdiffusion' that only recently 2002 was modeled fully (by us , published Physica A) thus allowing us to accurately model the uncertainties of randomness in prices. Also we show case the interactions-traders model of Excess demand and the susceptibility of bull/bear consensus graphs3,4.

forec. 121 continued

Oracle prices $29.96 and our proprietary probabilistic indicators (that is why we showcase them for 'free', we are seeking subscribership clientele)...along with introducing nonextensive statistics describing superdiffusive processes such as markets stocks prices , we also coauthored the qRMT random matrix theory qEntropy nonextensive statistical ensembles Wogner statistics...in the 1950's developed tpo describe complex interactions in nuclear matter (approximately), we make it precise in accuracy of quantifying uncertainty...therefore yet again we have developed the qRMT indicator graph1 here shown with scaled price data for dynamical 1says/interval forecast. See recent forecasts for more details and long term forecasts of weeks to months. Also note that we are automating this service, visit us soon for client-side free web site analytics software.

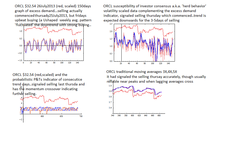

Forecast 120: 13June2013-21June2013

Oracle $34.25 13June2013 closing price...the selling today was forecasted accurately, and the proprietary indicators are telling us more room for selling exists on 1day interval data, and the weekly scale of interavls of 4days/interval is however telling us that a bottom has been formed and buying is about to commence for 3-5intervals or ~20days.

So how does this work... the fluctuations on 1days time scale is 3-5days of peak to trough and again 3-5 days trough to peak... this is 'embedded' in the longer time scales of 'visually' self-similar fluctuations of 3-5intervals of 4days/interval and so forth, and therefore as the uptrend long term commences there will be fluctuations of selling downwards along the uptrend...Add to this the well know (published elsewhere by other authors) options expiry 21June2013 positions around $34.50 'pull' upwards and we expect a short selling cycle today 14June2013 through possibly tuesday though a shallow selling to be followed by buying towards the pin the price on the options by next friday... this unless a major market downturn occurs as occasionally happens to trend ORCL prices downwards with the S&P500. And note further that the expectation by options next month 21July2013 is yet between $34.50 ~ $3

So how does this work... the fluctuations on 1days time scale is 3-5days of peak to trough and again 3-5 days trough to peak... this is 'embedded' in the longer time scales of 'visually' self-similar fluctuations of 3-5intervals of 4days/interval and so forth, and therefore as the uptrend long term commences there will be fluctuations of selling downwards along the uptrend...Add to this the well know (published elsewhere by other authors) options expiry 21June2013 positions around $34.50 'pull' upwards and we expect a short selling cycle today 14June2013 through possibly tuesday though a shallow selling to be followed by buying towards the pin the price on the options by next friday... this unless a major market downturn occurs as occasionally happens to trend ORCL prices downwards with the S&P500. And note further that the expectation by options next month 21July2013 is yet between $34.50 ~ $3

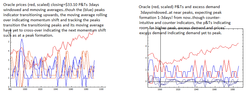

Forecast 118: 03June2013-10June2013

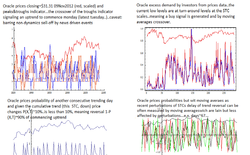

Oracle prices $33.78 ...the several proprietary indicators are graphed, signals are for buying to commence in ORCL stock as early as monday 03June2013 for 3-5days, and with longer term trends a selling for 10-25days to commence following... yet interspersed with downtrending 3-5day fluctuations...see next qRMT set of graphs.

forecast 118: continued

Oracle $33.78 indicators gra[hed are qRMT random matrices' probabilities..see graphs for details and menu left 'capabilities' for further info. Forecast is buying to commence for 3-5days for ~1.1%, and selling downrending long term forecast a selling downtrend with its own 3-5day fluctuations to commence following and for 15-25days.

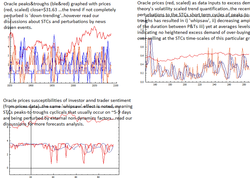

Forecast 117 24May2013weekend

Oracle $34.05 buying signaled to commence next trading day by excess demand and susceptibility but P&Ts peaks&troughs probabilities have yet to show a trough formed, this last indicating the potential for fluctuations during the upcoming uptrend buying as a 'true bottom' of the trough is formed.

Forecast 117 24May2013weekend

Oracle 24May2013 closed at $24.05, signals from several of our proprietary indicators were that buying was to commence within 1-2 trading days depending on indicator and for 3-5days until next peak...here qRMT random matrices theory , which we coauthored and published in 2001,2002 and which quantify nonlinear statistics of complex systems such as many interacting traders markets with very high accuracy, see menu left 'capabilities' page...

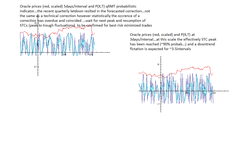

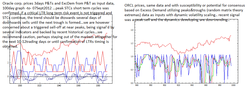

Forecast 116: 21May2013-28May2013

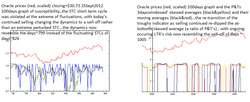

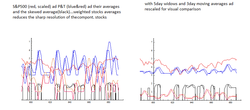

Oracle $35.13 closing prices (red, scaled) graphed scaled for visualization...We present our proprietary indicators which are capable of quantifying the complex statistics (nonlinear stochastics) of markets. We utilize random matrix theory, interacting traders models and derive a) bull/bear sentiment excess demand b) susceptibility of investors to follow trends or consensus c) highly accurate forward probability forecasts of trend reversals.

We present 1day ticks and 4days/interval prices data statistics and the forecasts associated. For explanations and details see the graphs insets and the menu left 'capabilities' section for more details. Also we are in the process of automating the client side of our web presence and you can expect to be able to perform similar analytics in the coming months.

We present 1day ticks and 4days/interval prices data statistics and the forecasts associated. For explanations and details see the graphs insets and the menu left 'capabilities' section for more details. Also we are in the process of automating the client side of our web presence and you can expect to be able to perform similar analytics in the coming months.

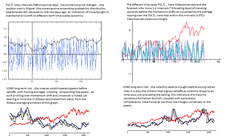

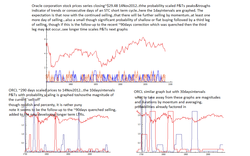

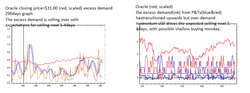

Forecast 114: 06May2013-13may2013

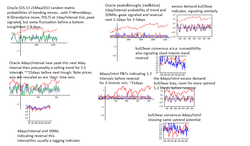

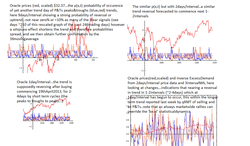

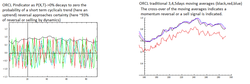

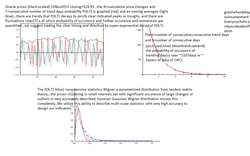

Oracle prices (red,scaled) and probabilistic forecasting...we utilize the recently created advanced 'super-statistics' in mathematics to correctly quantify occurence of events...this allows us to derive indicators based fully on these statistics (qRandom Matrices AND nonextensive statistics) that make it possible to forecast trends and trend reversals in a)prices b) demand c) sentiment... quantifying such probabilities along the way. See graphs for forecasts and menu left for details.

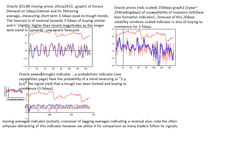

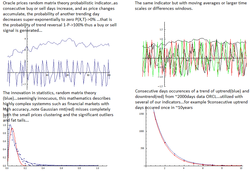

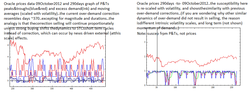

Forecast 113: 29April2013-05May2013

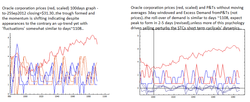

Oracle $32.26 prices close (red, scaled)...the probabilistic proprietary inicator P(X,T) X=$prices toral of trend T=#consecutive days in trend...graphed at several #days/interval for different scales' self-similar fluctuations' probabilities of occurence of short, medium and long term trends...and given that P(X,T) is a quantifier of probability of occurence of a trend, its remainder 1-P(X,T) is the probability of a reversal of a trend!! All this scheme needs is precise probabilities to make it a risk calculator...we claim this Random Matrix Theory nonextensive statistics probabilistic proprietary indicator is just that! See our menu left 'capabilities' pages for more details and our other indicators. For more trends and forecasts, read more in the previous week's forecasts and discussions.

Forecast 112: 22April2013-29April2014

Oracle prices (red, scaled) $32.43closing...the graphs are of the consecutive trending days of 'peaks&troughs', as inputs to the probability of occurence of such consecutive trend days, and note the probability of more trend days decay near-exponentially...as these are probabilities, the 1-p(x,t) is the probability of a reversal of the trend, thus we are able to dynamically quantify the forward forecasted probability of changes in the market stocks here Oracle...see graphs for explanations and the short term forecasts, and scroll down for longer term forecasts and by other probabilistic methods.

Forecast 112 continued

Interaction between traders with their own bias of bullish or bearish sentiment produces excess demand or supply, this proportional with market depth to the changes in prices...we utilize prices data, sentiment data and trend strength data as input for our ExcessDemand theory of market dynamics...here we graph several of these utilizing various time windows. See menu left 'capabilities' and the graphs for details and current forecasts by this method.

Correction to graph 2(top right): the forecast should read '...of buying before peak is formed on this 1day.interval', or as the ExcessDemand moving average line crosses over.

Correction to graph 2(top right): the forecast should read '...of buying before peak is formed on this 1day.interval', or as the ExcessDemand moving average line crosses over.

Forecast 113: 29April2013-05May2013

Oracle prices $32.26 closing (red, scaled) and the P(X,T) probability of trend occurence with T=#trend days and X=$trend cumulative prices...the qRMT random matrix theory P(X,T) is a very accurate statistics for complexity and interacting random systems such as economics markets and traders behavior ...see menu left 'capabilities' and scroll thrpugh previous forecasts for details...

Notes: the forecast for ORCL is selling 1-2 days, buying to commence on longer trends next few days see the graphs explanatory details an previous forecasts...These 1days/interval are often overriden or shifted by market wide forces as are longer ~8days/interval say by earnings reports and so on...so let us update you by discussing briefly market wide forces currently affecting us.

The S&P500 is a good measure of economics...it is supposedly 'difficult' to track however we showed several months ago that by our P(X,T) and P&Ts+p(x,t) our very precise probabilistic indicators that even weighted averages such as S&P500 whose characteristics we were the first to fully explain in 2002, is easily forecasted and risk quantified for further risk-reward portfolio optimization...we will present our LTRs long term risk updates next few days. In the meanwhile we note that the S&P500's VIX volatility derived ETFs are actually an even better indicator of market direction! To summarize, the bullish trend forecast by such indicators has now been revised and a reversal is forecasted imminent, with UVXY inverse(to S&P500 directly proportional to VIX) ETF price objectives of 13.0 now ~6.41, of SVXY directly proportional (to S&P500 and inversely to VIX) ETF to 69.0 now ~87.21...thus VIX volatility which inversely tracks S&P500 now at ~13.5 which drops when bullish consensus dominates, is expected at high levels soon... its ETFs UVXY up and SVXY down are inications of price dropping in the S&P500 itself expected at pre recent highs

Notes: the forecast for ORCL is selling 1-2 days, buying to commence on longer trends next few days see the graphs explanatory details an previous forecasts...These 1days/interval are often overriden or shifted by market wide forces as are longer ~8days/interval say by earnings reports and so on...so let us update you by discussing briefly market wide forces currently affecting us.

The S&P500 is a good measure of economics...it is supposedly 'difficult' to track however we showed several months ago that by our P(X,T) and P&Ts+p(x,t) our very precise probabilistic indicators that even weighted averages such as S&P500 whose characteristics we were the first to fully explain in 2002, is easily forecasted and risk quantified for further risk-reward portfolio optimization...we will present our LTRs long term risk updates next few days. In the meanwhile we note that the S&P500's VIX volatility derived ETFs are actually an even better indicator of market direction! To summarize, the bullish trend forecast by such indicators has now been revised and a reversal is forecasted imminent, with UVXY inverse(to S&P500 directly proportional to VIX) ETF price objectives of 13.0 now ~6.41, of SVXY directly proportional (to S&P500 and inversely to VIX) ETF to 69.0 now ~87.21...thus VIX volatility which inversely tracks S&P500 now at ~13.5 which drops when bullish consensus dominates, is expected at high levels soon... its ETFs UVXY up and SVXY down are inications of price dropping in the S&P500 itself expected at pre recent highs

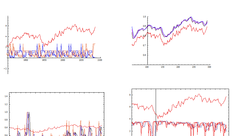

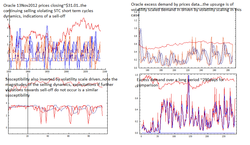

Forecast 112 continued

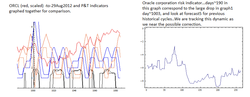

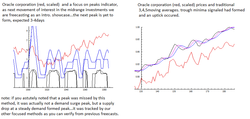

As a reference for short time scale dynamical evolution we graph the prices and probabilities from 19April2012...these are to be compared with today's data and graphs

Forecast 112 continued

Oracle prices 19th April2012 and our qRMT q-parameterized random matrix theory P(X,T) T=#consecutive trend days X=$totaltrendprice...we graph the short term and long term price trends here...see graphs for details and forecasts, and for an introduction to the theory see the menu left 'capabilities' and read through some previous forecasts.

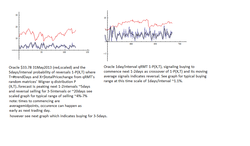

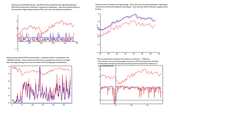

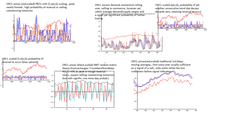

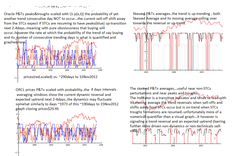

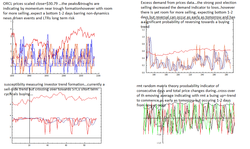

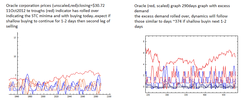

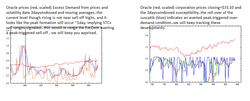

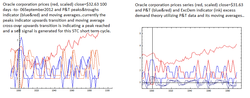

Forecast 111: 16April2013-22April2013

Oracle (red, scaled) prices $33.43 and several indicators with a forecast for the short term trend...for longer trends see menu left 'LTRs' section, our recent forecasts, and or subscribe!

We forecasts several days of buying of Oracle stock, followed by the short reversal of the 3-5days peak to trough type. For longer term LTRs risk, we forecast selling of Oracle stock lasting ~2-6intervals of 5days/interval before the long term fluctuations reverse to the upside.

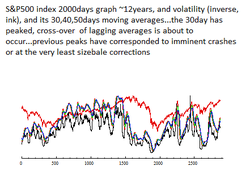

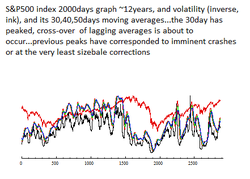

Market wide, a selloff or correction had been forecasted by us as by others as about to occur, it recently has begun to show signs of occuring, with last week ~2.4% buying at peaks giving way to gold dropping with GLD an indicator dropping ~15%,, S&P500 dropping %2 on monday, then rebounding about that on tuesday, and as we write this on 17April2013, redropping ~1.5% heading lower, with volatility VIX at ~16.3, UVXY inverse S&P500 ETF at ~7.8 up ~10% and SVXY correlated with S&P500 at ~94 down ~6% and dropping...directionality for the markets is then requested...well, volatility reversion to mean told us a few weeks ago a correction is upcoming (see menu LTRs and recent and previous forecasts), with even if this a technical correction of about ~4% and if to be rebounded as seems likely by qe quarterly easing a large correction move to the downside is forecasted at the latest to increase in probability by the spring doldrums when high volumes of shares trading hands 'winds' no longer help fill the sails of the market and the rebalancing between real market worth, economic realities and risk appetite (volume) is weighed against qe and its bolstering effects,AND as the 4-6 years crash cycle known about since early 1900's , and which recently 2007 lost ~50% of the S&P500 value is forecasted to hit.

Forecasts have been for S&P500 to climb yet higher, to ~1800 price targets, for Vix to decline to bullish certainty of ~8, of UVXY to drop to ~6.49 which was then revised to ~3.4...these meaning a bull market continuing into summer...QE quantitative easing may yet drive this market higher if real economic recovery is higher than expected....However the two factors of i) 4-6years crashes ii) Gold market turning into an analysts call of Bear market and selling off may yet cause it to falter, with the other factors of iii) large may-june months volume drop, iv) economic factors triggering the selloff at bull sentiment highs as has been shown to occur in previous crashes (meaning larger than correction). We personally feel it can occur as soon as this week (low probab.) and as late as late summer (high probab.) this last likely as post World War II -like economic patterns repeat themselves and with the 4-6year cycle shifting out of phase or being delayed by government programs meant to stimulate the economy.

We forecasts several days of buying of Oracle stock, followed by the short reversal of the 3-5days peak to trough type. For longer term LTRs risk, we forecast selling of Oracle stock lasting ~2-6intervals of 5days/interval before the long term fluctuations reverse to the upside.

Market wide, a selloff or correction had been forecasted by us as by others as about to occur, it recently has begun to show signs of occuring, with last week ~2.4% buying at peaks giving way to gold dropping with GLD an indicator dropping ~15%,, S&P500 dropping %2 on monday, then rebounding about that on tuesday, and as we write this on 17April2013, redropping ~1.5% heading lower, with volatility VIX at ~16.3, UVXY inverse S&P500 ETF at ~7.8 up ~10% and SVXY correlated with S&P500 at ~94 down ~6% and dropping...directionality for the markets is then requested...well, volatility reversion to mean told us a few weeks ago a correction is upcoming (see menu LTRs and recent and previous forecasts), with even if this a technical correction of about ~4% and if to be rebounded as seems likely by qe quarterly easing a large correction move to the downside is forecasted at the latest to increase in probability by the spring doldrums when high volumes of shares trading hands 'winds' no longer help fill the sails of the market and the rebalancing between real market worth, economic realities and risk appetite (volume) is weighed against qe and its bolstering effects,AND as the 4-6 years crash cycle known about since early 1900's , and which recently 2007 lost ~50% of the S&P500 value is forecasted to hit.

Forecasts have been for S&P500 to climb yet higher, to ~1800 price targets, for Vix to decline to bullish certainty of ~8, of UVXY to drop to ~6.49 which was then revised to ~3.4...these meaning a bull market continuing into summer...QE quantitative easing may yet drive this market higher if real economic recovery is higher than expected....However the two factors of i) 4-6years crashes ii) Gold market turning into an analysts call of Bear market and selling off may yet cause it to falter, with the other factors of iii) large may-june months volume drop, iv) economic factors triggering the selloff at bull sentiment highs as has been shown to occur in previous crashes (meaning larger than correction). We personally feel it can occur as soon as this week (low probab.) and as late as late summer (high probab.) this last likely as post World War II -like economic patterns repeat themselves and with the 4-6year cycle shifting out of phase or being delayed by government programs meant to stimulate the economy.

Forecast 109: 08April2013-16April2013

Oracle prices $32.36 (red, scaled) and P(X,T) qRMT probabilistic random matrix theory quantifier of probability of occurences of T=#consecutive days of a trend X=$additive cumulative prices , with 3days and 8days intervals...

The trend is expected upwards following market forces driven higher by several factors such as fed quantitative easing and seasonal risk appetite pre spring low volumes and potential sell offs.... this expected after the recent selloff in ORCL which coincided ~90days cyclicals with a near estimates 'letdown' earnings report. Expect 3-5days peak-to-trough cyclicals to continue with an upwards trend continuing towards spring.

For market wide analytics see LTRs previous forecasts and menu left and stay tuned for our free forecasts. Summary: We are yet looking at 4-6 year cycles of very large market wide corrections, these recently in 2007-2008 had a ~50% losses of S&P500... we note the crash or meltdown occurs at very low volatility as bullish consensus dominates right up to the crash...this time however qe quantitative easing is driving markets higher (simplified) adding to a lowering of uncertainty or volatility which has already gone lower than precrash2007 levels (see our many forecasts for further discussion)...with volatility as measured by VIX expected to drop to ~8-9 before reversing equivalently the ETF UVXY at ~6.5 (currently 7.1!!) expected before reversing, will this be the pre corrective or crash peak? stay tuned next several weeks as we discuss this in our weekly (or more frequent) newsletter and free forecasts or subscribe for greater access and information.

The trend is expected upwards following market forces driven higher by several factors such as fed quantitative easing and seasonal risk appetite pre spring low volumes and potential sell offs.... this expected after the recent selloff in ORCL which coincided ~90days cyclicals with a near estimates 'letdown' earnings report. Expect 3-5days peak-to-trough cyclicals to continue with an upwards trend continuing towards spring.

For market wide analytics see LTRs previous forecasts and menu left and stay tuned for our free forecasts. Summary: We are yet looking at 4-6 year cycles of very large market wide corrections, these recently in 2007-2008 had a ~50% losses of S&P500... we note the crash or meltdown occurs at very low volatility as bullish consensus dominates right up to the crash...this time however qe quantitative easing is driving markets higher (simplified) adding to a lowering of uncertainty or volatility which has already gone lower than precrash2007 levels (see our many forecasts for further discussion)...with volatility as measured by VIX expected to drop to ~8-9 before reversing equivalently the ETF UVXY at ~6.5 (currently 7.1!!) expected before reversing, will this be the pre corrective or crash peak? stay tuned next several weeks as we discuss this in our weekly (or more frequent) newsletter and free forecasts or subscribe for greater access and information.

Forecast 01April2013-09April2013

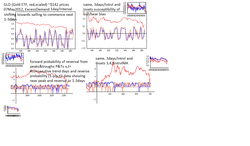

Oracle prices 03April2013 $32.45... The recent dip in price due to earnings let down was bought into, and regular fluctuations that occur 3-5days trough-peak resumed or are assumed to resume with selling at forecasted peak having occured today...the several proprietary indicators (from physics based phase transitions like theoretical approaches) are graphed along with inset explanations. For more market wide analysis continue reading the below forecasts next graph down. For details of the probabilistic models see menu left 'capabilities' and 'LTRs'.

Forecast 01April2013-03April13

Oracle prices (red, scaled) closing $32.54 01Aprl2013,$32.74 02Aprl2013...the trend after recent 'disappointing' earnings reports quarterlies which dropped the price from $36.50 to $31.00 was upwards as the price dip was bought into... statistically the uptrend towards a short term peak is at T=3-5days from lows depending on X=strength of price changes as P(X,T), the qRMT random matrix theory probability distribution indicator 'Pindicator' (our proprietary model marketing name...see menu left 'capabilities' for more descriptions) which is expected ~90% probability pf prices to reverse or that it has reached a short term peak... that said, the last ~10% is a small yet significant probability of occurence, and as today proved by continued buying to $32.74... expect short term cycles to resume with fluctuations downwards next 1-3days barring market wide rallying news driven forces. This can however be overriden by market wide and or news driven forces as we discuss next., this can be modeled easily by longer intervals say 5days/interval data with focus on longer statistical intervals which yet describe even such market wide effects see our discussions also previous forecasts and meus left. In fact long term effects become so easily modeled that traditional moving averages, bands, points&figures become very good at forecasting...it is at higher frequencies such as we cover here, AND the interactions dynamics of corrections and crashes AND the precise quantification of statistical probability of market risk movement direction and dynamics of bias and or excess demand that sets our recently developed theoretical physics of complex and random systems AND qRMT random matrix theory methods apart from the rest as we provide the most precise quantitatification of risk by our proprietary indicators.

Note: the trend market wide is upwards by market forces as S&P500 (for example) rally expected until spring, pulling ORCL prices upwards with it.

The S&P500 itself free of earnings surprises, it continues to rally, driven by economic news, risk appetite, irrational exuberance, and of very importance fed intervention....it having rallied early in the first half of the year as in 2011,2012, it is expected to drop in the spring to summer low volume periods, even more than the expected correction which was forecasted for march-april but which was perturbed or quenched out by QE driven rallying. The S&P500 price target by trends is several hundreds of points above current highs, which above the all time highs of 2007 were recently broken through 4th week March in 2013....if one looks at the volatility index VIX inversely correlated with S&P500, one sees it at all time lows of ~12, and expected to go lower yet....its ETFs UVXY ~7.43 which is also inversely correlated with S&P500 (and SVXY nonlinealry directly with S&P500 or inverse to VIX) are expected to continue in the rally direction, with UVXY( currently ~7.43) expected at ridiculously low levels of 6.49 and SVXY(~93) at 109 or VIX(~12) of 7-9!!!! meaning uncertainty in markets almost nonexistent, meaning consensus at high bullish sentiment, a recipe for disaster of panic driven first-to-sell in usual free market economies.....

The market is not free however...it stopped being free when the regulating agencies began to manipulate the markets with the recent quantitative easing by the fed acting as a money pump (printed as deemed required) striking the cyclically fluctuating market dynamics on a monthly regular periodic driving timing. This isn't a mathematically precise thing the fed is doing, say responding with optimized stochastic feedback control at SR stochastic resonance amplitude vs. variance windows thereby optimally counteracting the downtrends causing uncertainties or noise or fluctuations (recently we proposed such a scheme to the fed utilizing generalized Black-Scholes -like stochastic feedback control)...it is simply periodic driving of the stochastic random and complex system the market is. This periodic driving is steady of sorts and will drive the market in the direction sought upwards if continued indefinitely, by printed monies borrowed against a sought recovery to be trickled into by driving a measure of the economy such as the stock markets to highs, enriching the ~10% of stock investors who actually profit, these 100% the ~1% of U.S. citizenry....Expectations and sentiment do matter however, greatly...and the expectation by the U.S. citizenry that an economic recovery is occuring spurs investment and hiring and housing recovery and so forth. When or does this driving stimuli... effectively equivalent to reducing below zero the prime lending rate, traditionally the fed's control mechanism... cease to function effectively? When its risk reducing effect given the diminishing returns due to cost of borrowing is compared to the real value of the assets equities etc. of the markets, something calculatable generally as the 'risk free rate of returns' traditionally calculated as based on the prime lending rate set by the fed is now additionally the qe quarterly easing rate set again by the fed, this going into a gigantic Black-Scholes like valuation model of the markets and economy with indices acting as asset equities...recent funding for large Manhattan project -like efforts to understand these complex and complicated dynamics have been set aside internationally re "complex systems institutes" tasked for economics and finance by NATO and other unlikely funders...it is expected however that the next meltdown will occur on its delayed schedule of 2013-2014 though it be quenched somewhat, and results from such institutes researches will be taken up following the repetitive damage.

Expect it when you least expect it....the volatility drops to all time lows as (stochasticity plateaus or levels of variances) phase transition (or scales transition, a form of frustrated continuous phase transition similar to glassy physics) from rapid fluctuations to quiescent periods of near determinism, reflected in consensus of bullish behavior dominating. The 'external' forces exposure due to the open system that markets informatics are (meaning uncertainty magnitudes are in reality not diminished, merely temporarily screened against or glossed over and or ignored, a form of irrational exuberance) then occur with magnified effects at peak amplitude-to-variance SR windows, with seemingly innocuous news rippling throughout the system and the system reverses, consensus fragments, the system here markets selling off. This occurs at highs, past highs at the point where even bears are due to continuing bullishness must seek to trade in the market direction, adding their temporarily bullish sentiment to the mix, meaning at the contrarian most bullish point which due to consensus is where most are not expecting it...See our next installment for an excess demand update, that being a phase transition bull bear theoretic model borrowed from glassy physics, magnetism, etc...

Note: the trend market wide is upwards by market forces as S&P500 (for example) rally expected until spring, pulling ORCL prices upwards with it.

The S&P500 itself free of earnings surprises, it continues to rally, driven by economic news, risk appetite, irrational exuberance, and of very importance fed intervention....it having rallied early in the first half of the year as in 2011,2012, it is expected to drop in the spring to summer low volume periods, even more than the expected correction which was forecasted for march-april but which was perturbed or quenched out by QE driven rallying. The S&P500 price target by trends is several hundreds of points above current highs, which above the all time highs of 2007 were recently broken through 4th week March in 2013....if one looks at the volatility index VIX inversely correlated with S&P500, one sees it at all time lows of ~12, and expected to go lower yet....its ETFs UVXY ~7.43 which is also inversely correlated with S&P500 (and SVXY nonlinealry directly with S&P500 or inverse to VIX) are expected to continue in the rally direction, with UVXY( currently ~7.43) expected at ridiculously low levels of 6.49 and SVXY(~93) at 109 or VIX(~12) of 7-9!!!! meaning uncertainty in markets almost nonexistent, meaning consensus at high bullish sentiment, a recipe for disaster of panic driven first-to-sell in usual free market economies.....

The market is not free however...it stopped being free when the regulating agencies began to manipulate the markets with the recent quantitative easing by the fed acting as a money pump (printed as deemed required) striking the cyclically fluctuating market dynamics on a monthly regular periodic driving timing. This isn't a mathematically precise thing the fed is doing, say responding with optimized stochastic feedback control at SR stochastic resonance amplitude vs. variance windows thereby optimally counteracting the downtrends causing uncertainties or noise or fluctuations (recently we proposed such a scheme to the fed utilizing generalized Black-Scholes -like stochastic feedback control)...it is simply periodic driving of the stochastic random and complex system the market is. This periodic driving is steady of sorts and will drive the market in the direction sought upwards if continued indefinitely, by printed monies borrowed against a sought recovery to be trickled into by driving a measure of the economy such as the stock markets to highs, enriching the ~10% of stock investors who actually profit, these 100% the ~1% of U.S. citizenry....Expectations and sentiment do matter however, greatly...and the expectation by the U.S. citizenry that an economic recovery is occuring spurs investment and hiring and housing recovery and so forth. When or does this driving stimuli... effectively equivalent to reducing below zero the prime lending rate, traditionally the fed's control mechanism... cease to function effectively? When its risk reducing effect given the diminishing returns due to cost of borrowing is compared to the real value of the assets equities etc. of the markets, something calculatable generally as the 'risk free rate of returns' traditionally calculated as based on the prime lending rate set by the fed is now additionally the qe quarterly easing rate set again by the fed, this going into a gigantic Black-Scholes like valuation model of the markets and economy with indices acting as asset equities...recent funding for large Manhattan project -like efforts to understand these complex and complicated dynamics have been set aside internationally re "complex systems institutes" tasked for economics and finance by NATO and other unlikely funders...it is expected however that the next meltdown will occur on its delayed schedule of 2013-2014 though it be quenched somewhat, and results from such institutes researches will be taken up following the repetitive damage.

Expect it when you least expect it....the volatility drops to all time lows as (stochasticity plateaus or levels of variances) phase transition (or scales transition, a form of frustrated continuous phase transition similar to glassy physics) from rapid fluctuations to quiescent periods of near determinism, reflected in consensus of bullish behavior dominating. The 'external' forces exposure due to the open system that markets informatics are (meaning uncertainty magnitudes are in reality not diminished, merely temporarily screened against or glossed over and or ignored, a form of irrational exuberance) then occur with magnified effects at peak amplitude-to-variance SR windows, with seemingly innocuous news rippling throughout the system and the system reverses, consensus fragments, the system here markets selling off. This occurs at highs, past highs at the point where even bears are due to continuing bullishness must seek to trade in the market direction, adding their temporarily bullish sentiment to the mix, meaning at the contrarian most bullish point which due to consensus is where most are not expecting it...See our next installment for an excess demand update, that being a phase transition bull bear theoretic model borrowed from glassy physics, magnetism, etc...

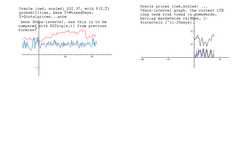

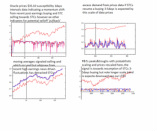

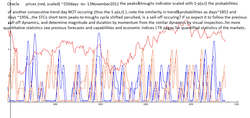

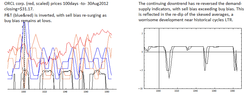

Forecast 104: Forecast 11March2012

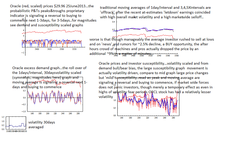

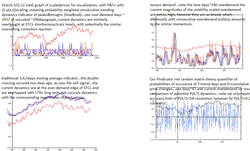

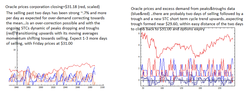

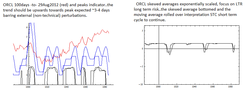

Oracle $34.71 closing price previous day...the rally continued from earnings season has a momentum, and has resulted in a delaying of the downtrend expected, with a seemingly sideways trading of ORCL following very closely the larger S&P500 market direction. The direction however is downtrending, with some analysts calling a 5% correction into the 2nd quarter earnings. We have mentioned that short term 3-5day trends have been burned out by perturbations of forces of news driven exuberance rally and fed and therefore have gone to medium scale 3day intervals, 5day intervals and 10day intervals long term scales...here graphed we show several proprietary indicators of 1days and 3days intervals, with explanatory comments and inset.

Summary: as short term 3-5days peaks-to-troughs have burned out by forces on the longer scales, and the ORCL stock has fluctuated sideways in a trading range near highs of ~90days cyclicals of ~$35.00, we have been tracking the medium to long term scale cyclicals, as we wish to forecast the timing of the downtrend from ~90days highs. Well, the peak occured with high probability ~10days ago, and the trend is downtrending for 3-5 X10dayintervals and by the medium 5days intervals P&Ts and Pindicators...

Notes: that being said, larger market forces are expected to push the limit of this 'wake' effect of the market rally, and we expect possibly one to two false second peaks before the sharper (if second peaks occur) sell off... of a so called correction pr actually a cyclical large scale oscillation a result of ~90days quarterly earnings periodic driving and uncertainty randomness driving forces acting together to form a slow large scale a) SR stochastic resonance (similar to the third kind, between the periodic and aperiodic types) like system effect. See LTRs longer term risk for more details on this effect and scroll down to forecasts ~80-100 for more discussions of these effects. We remind you of our discussion of other driving periodic forces, of b) options expiry end of month which drives stocks prices towards expected expiry prices (see cited papers), of c) fed monthly QE a current driving perturbation intended to counteract downtrend pull and uncertainty which has resulted in uptrending markets and the current rally to highs, d) seasonal winter summer interest re demand and risk appetite the sell in may and go away effect which resulted this previous year in a >150% disparity in gains between the winter trading season and the summer season e) the 4year election cycle and political and policy turnover effect which has coincided with 4-6 year LTR long term risk events of economic crashes resembling economic meltdowns, at least the last 3-4 cycles, with previous lower magnitude crashes having also occured per cyclical and one expected barring effectiveness of fed QE this trading year and forecasted this upcoming spring summer low volume low gains season.

Summary: as short term 3-5days peaks-to-troughs have burned out by forces on the longer scales, and the ORCL stock has fluctuated sideways in a trading range near highs of ~90days cyclicals of ~$35.00, we have been tracking the medium to long term scale cyclicals, as we wish to forecast the timing of the downtrend from ~90days highs. Well, the peak occured with high probability ~10days ago, and the trend is downtrending for 3-5 X10dayintervals and by the medium 5days intervals P&Ts and Pindicators...

Notes: that being said, larger market forces are expected to push the limit of this 'wake' effect of the market rally, and we expect possibly one to two false second peaks before the sharper (if second peaks occur) sell off... of a so called correction pr actually a cyclical large scale oscillation a result of ~90days quarterly earnings periodic driving and uncertainty randomness driving forces acting together to form a slow large scale a) SR stochastic resonance (similar to the third kind, between the periodic and aperiodic types) like system effect. See LTRs longer term risk for more details on this effect and scroll down to forecasts ~80-100 for more discussions of these effects. We remind you of our discussion of other driving periodic forces, of b) options expiry end of month which drives stocks prices towards expected expiry prices (see cited papers), of c) fed monthly QE a current driving perturbation intended to counteract downtrend pull and uncertainty which has resulted in uptrending markets and the current rally to highs, d) seasonal winter summer interest re demand and risk appetite the sell in may and go away effect which resulted this previous year in a >150% disparity in gains between the winter trading season and the summer season e) the 4year election cycle and political and policy turnover effect which has coincided with 4-6 year LTR long term risk events of economic crashes resembling economic meltdowns, at least the last 3-4 cycles, with previous lower magnitude crashes having also occured per cyclical and one expected barring effectiveness of fed QE this trading year and forecasted this upcoming spring summer low volume low gains season.

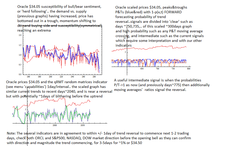

Forecast 103: 25February2013 Long Term Risk forecasts

Oracle prices close $34.23 25Feb2013... we shifted our forecasts as with the news driven market to longer term risk LTRs as the shorter term trending cycles of 6-10days completely were perturbed out into fast 1day to 2day fluctuations but within the longer term cycles of 30-50days of trough-to-peak and as a cycle is back to troughs double these numbers and you get the ~90days cycles we all have been looking at recently in the markets...for reasoning behind these cales and what forms a cycle read our recent forecasts from ~80-100 and the LTRs risk left menu...

Anyways, the S&P500 has broken its all time highs and quickly trended down again... for ORCL, the peak that was coincidentally formed was a high of ~90days cycles... expectations supported by moving averages and probabilistic proprietary indicators are that the trend is downtrending to a bottom or trough to be reached in 15-25days or so barring more news driven perturbations and intervention by the fed to 'bolster prices', a move that may temporarily drive prices upwards but would (as it is not an optimal dynamic stochastic feedback control but merely a steady state like approach of semi continuous monthly periodic 'shocks') in the longer term yet not manage to prevent the correction effects that go hand in hand with the cycles..So! if you folks out there really want to quench corrections and crashes, suggest to your local fed to invest in some inexpensive "stochastic feedback control" software and have them 'shock' the system monetarily ( by infusing money and or QE and or prime lending rate manipulation and so forth) by computationally optimized perturbations and as when monetary easing and interest rates setting would have optimal effect as calculated with mathematical precision NOW AVAILABLE! The question then would be how free would the resulting free market be? However folks, there is a world of difference between preventing a crash that wipes out 50% of all economic wealth and merely manipulating a market for gain.

Summary: ORCL at peak of ~90days cycles presumably, and trend is expected dowtrending barring perturbations and or interventions to the upside and which would have their own set of delaying risk .

Anyways, the S&P500 has broken its all time highs and quickly trended down again... for ORCL, the peak that was coincidentally formed was a high of ~90days cycles... expectations supported by moving averages and probabilistic proprietary indicators are that the trend is downtrending to a bottom or trough to be reached in 15-25days or so barring more news driven perturbations and intervention by the fed to 'bolster prices', a move that may temporarily drive prices upwards but would (as it is not an optimal dynamic stochastic feedback control but merely a steady state like approach of semi continuous monthly periodic 'shocks') in the longer term yet not manage to prevent the correction effects that go hand in hand with the cycles..So! if you folks out there really want to quench corrections and crashes, suggest to your local fed to invest in some inexpensive "stochastic feedback control" software and have them 'shock' the system monetarily ( by infusing money and or QE and or prime lending rate manipulation and so forth) by computationally optimized perturbations and as when monetary easing and interest rates setting would have optimal effect as calculated with mathematical precision NOW AVAILABLE! The question then would be how free would the resulting free market be? However folks, there is a world of difference between preventing a crash that wipes out 50% of all economic wealth and merely manipulating a market for gain.

Summary: ORCL at peak of ~90days cycles presumably, and trend is expected dowtrending barring perturbations and or interventions to the upside and which would have their own set of delaying risk .

FORECAST 103: 25February2013...long term risk forecasts

Oracle closing $34.23 prices ... the STCs short term cycles have been shifted out of 6-10days trough-to-peak-to-trough to fluctuations of 1-2days with no trend or reason a 'sideways' market as it called...however the longer term risk is yet a cyclical trending dynamic and we show the moving averages and the proprietary probabilistic indicators we utilize.

Summary, peak was formed on 30-50days trends or cyclicals (recently thus the ~90 days cycles) a week or so ago, and current expectation is downtrending towards a trough to be formed in ~10-25days

Summary, peak was formed on 30-50days trends or cyclicals (recently thus the ~90 days cycles) a week or so ago, and current expectation is downtrending towards a trough to be formed in ~10-25days

Forecast 102: 11February2012...are STCs resuming?

Oracle prices $34.90 the prices scaled for visualization and the P&T's peaks&troughs indicator scaled with probability of occurence of consecutive trend days (blue&red)...the expectation is that an uptrend will commence for 3-5intervals.

The quarterly earnings recently with bullish driving keeping prices of ORCL and other tech sector stocks near highs, meaning the regular rhythm of 3-5days-to-3-5days peaks-to-troughs-to-peaks was 'shifted' out of rhythm or into ~20-40days rhythms...please read our recent longer term analytics for forecasts and graphs of the statistics...we then reported the longer term statistics in recent previous forecasts that included even the high levels of prices by news driven 'forces' as just another fluctuation though on the longer scales.

Summary: long term forecast is for a downtrend or a correction or pullback take your pick that is to commence as early as tomorrow but within 1-2intervals of 5days/interval and to also last for 3-5intervals and with magnitudes of ~4%-7%...within this is shorter term 1days/intervals fluctuations of which we are seeing potentially the resumption of and of 3-5days trough to peak and of magnitudes of ~2%-3%. As we confirm the shorter term cyclicals resuming we will report more detailed technicals or statistical graphs of the direction and magnitude and timing.

The quarterly earnings recently with bullish driving keeping prices of ORCL and other tech sector stocks near highs, meaning the regular rhythm of 3-5days-to-3-5days peaks-to-troughs-to-peaks was 'shifted' out of rhythm or into ~20-40days rhythms...please read our recent longer term analytics for forecasts and graphs of the statistics...we then reported the longer term statistics in recent previous forecasts that included even the high levels of prices by news driven 'forces' as just another fluctuation though on the longer scales.

Summary: long term forecast is for a downtrend or a correction or pullback take your pick that is to commence as early as tomorrow but within 1-2intervals of 5days/interval and to also last for 3-5intervals and with magnitudes of ~4%-7%...within this is shorter term 1days/intervals fluctuations of which we are seeing potentially the resumption of and of 3-5days trough to peak and of magnitudes of ~2%-3%. As we confirm the shorter term cyclicals resuming we will report more detailed technicals or statistical graphs of the direction and magnitude and timing.

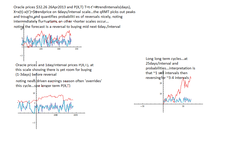

Forecast 101: 07Febryary2013

Oracle prices $35.10 ..the several indicators are showing the earnings season artificially heightened levels of price and demand as news driven speculation drives prices higher...

This is invariably followed by investor selloffs either as profit taking or as disatisfaction...this 'psychology' of the market, the chartist tracking of this is graphed and shown (see LTRs menu left) in our previous forecasts also the cyclical quarterly ups and downs effects of this artificial perturbing effect see forecasts76-80, previous earnings season ~90days ago and recently also ...you will note the sell offs that follow such highs.

The normal cyclicals if unperturbed are cyclical 5day cycles that is weekly cycles///then are options expiry cycles monthly, then quarterly earnings 3month cycles then yearly cycles then 4year or thereabouts 'political' cycles of elections and with such of policy and economics and these not surprisngly coincide with the STCs short term cyclicals of 3-5days peaks to troughs, the quarterly cyclicals pf ~90days peaks and troughs then the 4-6 years economic meltdowns we have been discussing in our LTRs long term risk menu left.

Therefore we are expecting post earnings resumption of STCs inside the MTCs medium scale fluctuations inside the LTRs long term fluctuations..it is a very mechanistic 'system' when mathematics a.k.a.'technicals' of randomness and fluctuatioons are considered, and very human when interactions between investors that produce the technicals are considered. The post earnings STCs are graphed left and we will present more of our proprietary indicators in the next few days if STCs do resume.

Summary: The trend by MTCs is downwards expectations of a 'pullback' or correction signaled by several indicators see previous forecasts and other methods extra Pittnachioff.com such as investor intelligence.com and other proven indicators... the STCs are however signaling a post earnings opportunity buying ...that is the STCs 1days intervals are signaling a buy opportunity at a trough of ORCL following 3-5days of selling.

Again we caution that at MTCs medium scale risk is signaling a 'pullback' or correction of ~4%-7% and as MTCs are 5days/interval next 3-5intervals once STCs are resumed and confirmed post earnings artificial perturbs.

Long term risk cyclicals are yet signaling impending or imminent (on decadal years scales 1- 6months is imminent!) meltdown...however note that 'this time' there is a counter pertubance that of the fed in the form of a non-sophisticated (meaning it is not a synchronized counter fluctuation to the negating fluctuations..that of mathematics of stochastic feedback control see our papers and references therein) but is a near constant driving force that of QEconstant quarterly easing...Will it work? to quench the 4-6years downwards crashes and meltdowns? Yes if brute force is applied consistently as the system will follow the driving (upwards) force exerted by the fed AND if the force is of sufficient strength to counteract the strongest fluctuations and (stochastic resonance) its amplification with the periodicity downwards...not an elegant solution but a solution.

This is invariably followed by investor selloffs either as profit taking or as disatisfaction...this 'psychology' of the market, the chartist tracking of this is graphed and shown (see LTRs menu left) in our previous forecasts also the cyclical quarterly ups and downs effects of this artificial perturbing effect see forecasts76-80, previous earnings season ~90days ago and recently also ...you will note the sell offs that follow such highs.

The normal cyclicals if unperturbed are cyclical 5day cycles that is weekly cycles///then are options expiry cycles monthly, then quarterly earnings 3month cycles then yearly cycles then 4year or thereabouts 'political' cycles of elections and with such of policy and economics and these not surprisngly coincide with the STCs short term cyclicals of 3-5days peaks to troughs, the quarterly cyclicals pf ~90days peaks and troughs then the 4-6 years economic meltdowns we have been discussing in our LTRs long term risk menu left.

Therefore we are expecting post earnings resumption of STCs inside the MTCs medium scale fluctuations inside the LTRs long term fluctuations..it is a very mechanistic 'system' when mathematics a.k.a.'technicals' of randomness and fluctuatioons are considered, and very human when interactions between investors that produce the technicals are considered. The post earnings STCs are graphed left and we will present more of our proprietary indicators in the next few days if STCs do resume.

Summary: The trend by MTCs is downwards expectations of a 'pullback' or correction signaled by several indicators see previous forecasts and other methods extra Pittnachioff.com such as investor intelligence.com and other proven indicators... the STCs are however signaling a post earnings opportunity buying ...that is the STCs 1days intervals are signaling a buy opportunity at a trough of ORCL following 3-5days of selling.

Again we caution that at MTCs medium scale risk is signaling a 'pullback' or correction of ~4%-7% and as MTCs are 5days/interval next 3-5intervals once STCs are resumed and confirmed post earnings artificial perturbs.

Long term risk cyclicals are yet signaling impending or imminent (on decadal years scales 1- 6months is imminent!) meltdown...however note that 'this time' there is a counter pertubance that of the fed in the form of a non-sophisticated (meaning it is not a synchronized counter fluctuation to the negating fluctuations..that of mathematics of stochastic feedback control see our papers and references therein) but is a near constant driving force that of QEconstant quarterly easing...Will it work? to quench the 4-6years downwards crashes and meltdowns? Yes if brute force is applied consistently as the system will follow the driving (upwards) force exerted by the fed AND if the force is of sufficient strength to counteract the strongest fluctuations and (stochastic resonance) its amplification with the periodicity downwards...not an elegant solution but a solution.

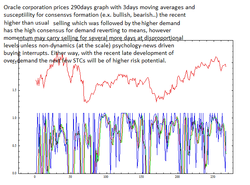

Forecast 99: 29January2013

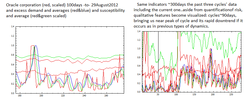

Oracle prices $35.34 ...we have due to earnings season shifted to weekly forecasts of ~5days intervals (ticks) as the STCs short term cyclicals of 1days intervals that last about 3-5days of troughstopeaks and similarly of 3-5days of peakstotroughs have been 'perturbed' to the longer scale cyclicals ...meaning that earnings artificially keep prices fluctuating near the uptrend or downtrend depending on how the overall big picture big economics news of the market forces drive the trend, and currently they have been uptrending due to active involvement by fed QE and the large numbers of upbeat economic reports.

The cyclicals then are approximately self-similar at medium time scales of 5days intervals with 3-5 'intervals' of trough to peak and 3-5 'intervals' of peak to trough with the current '4weeks' of uptrending representing a near peak that is expected to sell off in the next interval or two. A profitable trade then is to leverage the expected ~4%-8% medium scale fluctuations into large profits by utilizing options of calls+puts called straddles see http://www.cboe.com for risks disclosures. Note that a ~4%-8% change in price translates to ~50%-100% ROI yet after the cost of the position is achieved at ~2%-3% on the expected way down , with potentially a similar profit on the 'return leg' as the prices then fluctuate trending back upwards. Currently we are heavily positioned on puts expecting the downtrend selloff following our very profitable uptrend portion of the trade that occured in the past several weeks.

Another profitable trade in the similar method is to trade earnings momentum...the earnings reports usually promote a few stocks with a 'beating estimates' or the 'underperforming' type...the trade is to place straddles on a few in each direction, the expected 4%-9% changes that begin showing or occuring in a few seconds after the opening bell showing which are the investor favorites, selling the none movers and retaining the bubbling ones, following this by end of day selling of the gaining sides of the positions with bubble anticlimactic deflation then regaining the other sides of the trades.... this often produces 20%-40% ROI in a few minutes with further 10%-20% in days to weeks...NOTE the straddle is by definition a zero risk (minus transactions costs) trade that profits by 'large' movement' of the stock optioned here 'large' ~3%-4% or greater. Summary: options leverage great gains...they lose great monies if unprotected thus a zero risk straddle of put+call is the trade advised...the profitability comes after the stock moves sufficient amounts of ~3% or more ...how to trade this? by a service such as ours that quantifies such movements forecasting their timing with sufficiently accurate timing, and or by known event driven movers such as earnings season and so forth.

Happy tradings.

The cyclicals then are approximately self-similar at medium time scales of 5days intervals with 3-5 'intervals' of trough to peak and 3-5 'intervals' of peak to trough with the current '4weeks' of uptrending representing a near peak that is expected to sell off in the next interval or two. A profitable trade then is to leverage the expected ~4%-8% medium scale fluctuations into large profits by utilizing options of calls+puts called straddles see http://www.cboe.com for risks disclosures. Note that a ~4%-8% change in price translates to ~50%-100% ROI yet after the cost of the position is achieved at ~2%-3% on the expected way down , with potentially a similar profit on the 'return leg' as the prices then fluctuate trending back upwards. Currently we are heavily positioned on puts expecting the downtrend selloff following our very profitable uptrend portion of the trade that occured in the past several weeks.

Another profitable trade in the similar method is to trade earnings momentum...the earnings reports usually promote a few stocks with a 'beating estimates' or the 'underperforming' type...the trade is to place straddles on a few in each direction, the expected 4%-9% changes that begin showing or occuring in a few seconds after the opening bell showing which are the investor favorites, selling the none movers and retaining the bubbling ones, following this by end of day selling of the gaining sides of the positions with bubble anticlimactic deflation then regaining the other sides of the trades.... this often produces 20%-40% ROI in a few minutes with further 10%-20% in days to weeks...NOTE the straddle is by definition a zero risk (minus transactions costs) trade that profits by 'large' movement' of the stock optioned here 'large' ~3%-4% or greater. Summary: options leverage great gains...they lose great monies if unprotected thus a zero risk straddle of put+call is the trade advised...the profitability comes after the stock moves sufficient amounts of ~3% or more ...how to trade this? by a service such as ours that quantifies such movements forecasting their timing with sufficiently accurate timing, and or by known event driven movers such as earnings season and so forth.

Happy tradings.

Forecast 98: 14January2013

Oracle closing $34.98 14Janu2013... the signals by indicators were to sell as of today which did commence.. however though today selling to $34.60 occured by closing quarterly earnings enthusiasm the latest news driven shifter (the previous recent shifter the fiscal cliff) of out of STCs short term cyclical peaks to troughs into MTCs medium term cyclicals peaks to troughs had the prices rise to slightly higher than the previous day's close. This actually allowed the satisfaction of trade placement for both directions in actuality...

However the continued buying and it seems to be diminshing should in 1-3 days become a selling and proportionately to how long STCs were violated, meaning an MTCs level of 4%-7% of 3-5intervals (see previous recent forecasts for continuity and details) and we set MTCs at 4-6days/interval. This is supported by sell signals that occured a few days ago were the three scales we track coincided as sell signals.

Then with sell signals generated what is the upside risk...news driven shifts 'a rally' that then are tracked by longer term cyclicals than we are featuring here, and that occur on scale of years by the way, and although they do have a small yet significant probability of occuring as do large crashes.

However the continued buying and it seems to be diminshing should in 1-3 days become a selling and proportionately to how long STCs were violated, meaning an MTCs level of 4%-7% of 3-5intervals (see previous recent forecasts for continuity and details) and we set MTCs at 4-6days/interval. This is supported by sell signals that occured a few days ago were the three scales we track coincided as sell signals.

Then with sell signals generated what is the upside risk...news driven shifts 'a rally' that then are tracked by longer term cyclicals than we are featuring here, and that occur on scale of years by the way, and although they do have a small yet significant probability of occuring as do large crashes.

Forecast 97: 08January2013

Oracle prices data closing ~$34.63 ... we had an editing technical difficulty recently where our graphs were not uploaded or rendered properly ...however as recent news driven perturbations of the STCs short term cyclicals caused shifts out of the regular dynamics of 1day tick intervals to longer periods for tracking useful trends we have moved to a near weekly forecast of MTCs medium term cyclicals ...see the P(X,T) indicator of qRMT random matrix theory nonextensive statistics for more indicators next graphs...

Summary: Recent peak was predicted accurately and selling occured as forecasted...occured for ~3days buying prematurely began but in keeping with quarterly earnings perturbations of news driven faux rallies. This will fluctuate in and out of STCs to MTCs (short to medium scale and then back) for the next week or two, so we are after recent fiscal fluctuations still in another STCs mode...Therefore we are providing weekly free forecasts or longer but with the full covered range of time scales by our several proprietary indicators.

Summary: cycles of STCs short term within cycles of MTCs medium term within LTRs cycles long term ...look for the coincided peaks of all three scales ~friday last which we showed occuring, to occur as forecasted with short term cyclicals fluctuating out of 3-5days trough to peak timing but within the more stable medium scale fluctuations of 3-5'INTERVALS' of ~5days/interval trough to or

peak...For LTRs long term cyclicals see our LTRS pages left menu and our regular forecasts keeping track of the multi year cyclicals. Note: if we were to recommend a trade given the current fluctuations it would not be at STCs short term scales utilizing stocks directly...we would recommend instead to wait for the next STCs or MTCs trough, buying a straddle of zero risk at which point in a few weeks the ~5%-8% uptrend leg by 100% in value of the call option increasing would have paid for all of the straddle, leaving all of the downwards leg of the put option which would be near zero 0% of value to recover its value making further riskless profit...timing recommended is to sit it out until the next confirmed bottom which will occur in 2-4'intervals' of ~5days/interval keep tuned in.

Summary: Recent peak was predicted accurately and selling occured as forecasted...occured for ~3days buying prematurely began but in keeping with quarterly earnings perturbations of news driven faux rallies. This will fluctuate in and out of STCs to MTCs (short to medium scale and then back) for the next week or two, so we are after recent fiscal fluctuations still in another STCs mode...Therefore we are providing weekly free forecasts or longer but with the full covered range of time scales by our several proprietary indicators.

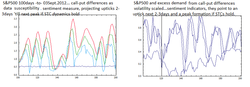

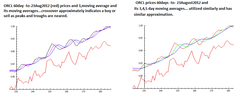

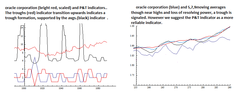

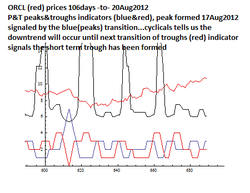

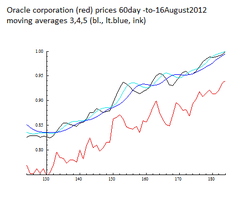

Summary: cycles of STCs short term within cycles of MTCs medium term within LTRs cycles long term ...look for the coincided peaks of all three scales ~friday last which we showed occuring, to occur as forecasted with short term cyclicals fluctuating out of 3-5days trough to peak timing but within the more stable medium scale fluctuations of 3-5'INTERVALS' of ~5days/interval trough to or